Our Bifurcated Economy Produces a Few Winners and Lots of Losers

The last three years have erased the broad-based economic advances made under Donald Trump and made things worse for the vast majority of Americans in their daily lives.

After a recent column, a classmate from college who I’ve not seen or talked to since whatever class we last had together in 1992 or 1993 accused me of being “angry” and not recognizing how great an economy Bidenomics is producing. He works for the Internal Revenue Service and lives in the recession-proof National Capital Region, which he claimed was “turbocharged” because of immigration. I don’t mean to pick on him (he is among the smartest people I've ever known), but I cite the exchange because I think it aptly illustrates how today’s economy is bifurcated largely by education levels and financial traits.

Let me explain.

First, if you have a college degree, odds are pretty good you’ve have a job in professional or business services, law, health care, technology, education, or government. That job likely comes with higher annual pay, health care coverage, and some sort of retirement plan like a 401(k) or pension (if you work in government). Your industry rarely requires layoffs, so you live with moderate-to-strong job security.

Next, interests rates may impact you on the margins and mostly by choice; meaning, you own a home and car(s) with locked in mortgage rates already, so only get impacted by higher home and car loan interest rates if you decide to buy a new house or car. Obviously, some people have to buy a new house or car because of a change in location due to a new job or a car accident, but for many new homes or cars are optional. You also make the decision to use credit cards to cover spending, so only get hit with higher credit cards interest rates if you don’t pay off the balance monthly.

Finally, for those who own a home or equities, rising home and stock prices have made you wealthier. Moreover, for those with liquid cash, higher interest rates have resulted in certificates of deposits or money market accounts with 5.0% interest rates that provide you with fairly decent returns on your cash. Life is mostly good for America’s college degree or higher holders.

All of the above notwithstanding, two issues still confront Americans holding college degrees that could result in them not benefitting from Bidenomics. For those with large student loans, the monthly payments could impact either or both buying a home and saving for retirement. Biden’s unconstitutional and grossly unfair student loan write-off isn’t helping most Americans with their student loans and creating a subcategory of winners and losers.

More challenging for America’s college degree holders is the ever-present urge to keep up with the Joneses. As my poor kids know all too well, I am a proud disciple of the lessons from the book “The Millionaire Next Door,” which I read every five years or so to remind me of the traits of those who become millionaires and those who don’t (and it isn’t tied to high annual net income). If you haven’t read the book, I strongly suggest you do. The research behind the book comes to two stark conclusions: (1) the vast majority of Americans live paycheck to paycheck regardless of how much they make each year, so don’t confuse luxury cars, McMansions, fancy clothes, and other signs of wealth as wealth; rather, most people spend virtually everything they make each year no matter their income brackets so the mid-six-figure doctor or lawyer has a net worth once assets and liabilities are dealt with fairly close to the Walmart greeter and (2) the only way to increase your net worth is to live below your means by making financially sound decisions on a daily basis.

Unfortunately, America has far too many of the former and far too few of the latter. If you are among the latter, Bidenomics and its destructive policies really aren’t impacting you much and you are getting wealthier because of the stock market rise and positive impact interest rates are having on your cash. These are the winners.

In stark contrast, if you lack a college degree, you likely have a job in trade, transportation, and utilities; construction; mining and logging; manufacturing; or leisure and hospitality. While some of these jobs are higher paying, many are not and most suffer from both wage stagnation and a prevalence of layoffs when the economy softens. In the latest update from the U.S. Bureau of Labor Statistics, of the 150,000 non-government jobs added last month, nearly 26% were in low-wage restaurants and bars, with just 20% in better paying industries like manufacturing and construction. Life for these Americans is simply much harder.

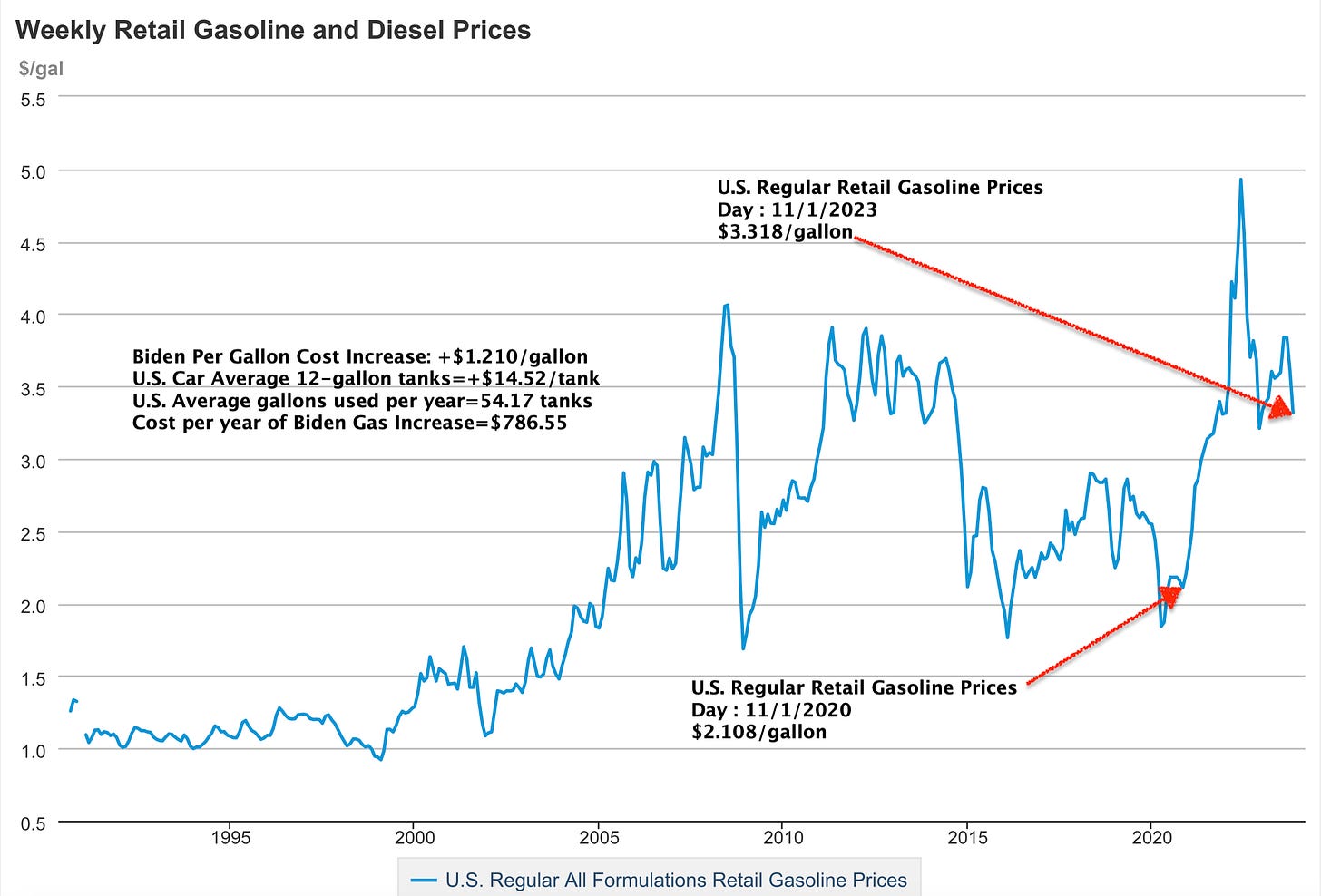

When it comes to buying items requiring the use of credit like homes and cars, these folks get hit again given higher borrowing rates married with likelier lower credit scores, which drives their borrowing rates even higher. These folks are hit with 16% interest rates on cars. Making matters worse, the amount of their car loans is over $38,000 on a seven-year loan, which is $6,000 more than it was in January 2020 and which means they’ll end up paying more than double for the car due to interest payments over those seven years. As noted in the chart above, due to higher gasoline prices, the amount they now spend on gasoline for their cars is up $786.55 for the year. When food inflation is factored in, along with the shrinkage of the products they are buying, Americans are paying more today than just four years ago and getting less. It is incredibly hard for first-time homebuyers (i.e., the young) to buy a house due to rising home prices and interest rates. This delays homeownership and all of the secondary and tertiary spending that comes with owning a home.

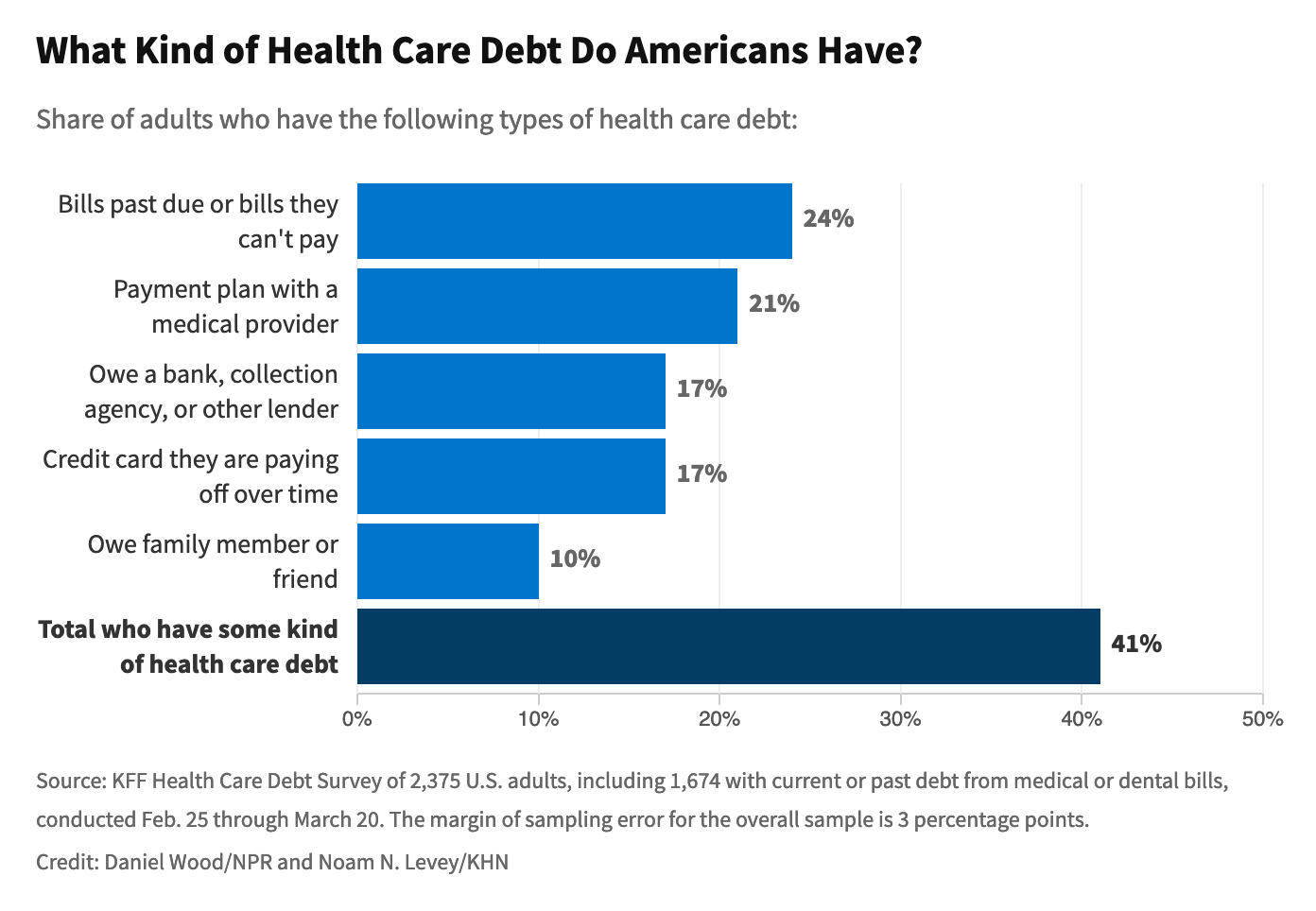

When credit card debt and interest rates on those cards are added to the mix, getting ahead becomes nearly impossible. The average credit card debt now stands at roughly $8,000 per card, with interest rates soaring past 21% per month. God forbid any of these Americans have a medical crisis that requires hospitalization, as that medical crisis will rapidly become a financial crisis given half of America lacks the cash to cover a $500 medical bill and nearly 100 million Americans carry health care debt.

In total, Americans now carry debt approaching $5 trillion dollars, with the interest rates on that debt higher than at any point in the last thirty years. Realistically, there is no way Americans will pay off this debt, which is why so many fund their day-to-day living with credit and resign themselves to die with debt. The generation of my grandfather which would never consider dying in debt has given way to generations of Americans who have no moral problem sloughing their debt off on the rest of us once they die. America unequivocally has become an instant gratification society. It is also why we are seeing an increase in defaults and in the number of car loans being issued covering more than one car; as in, the car loan covers the car the person is now driving along with the car they no longer drive, but which still had debt on it, which the banks just folded into the new loan.

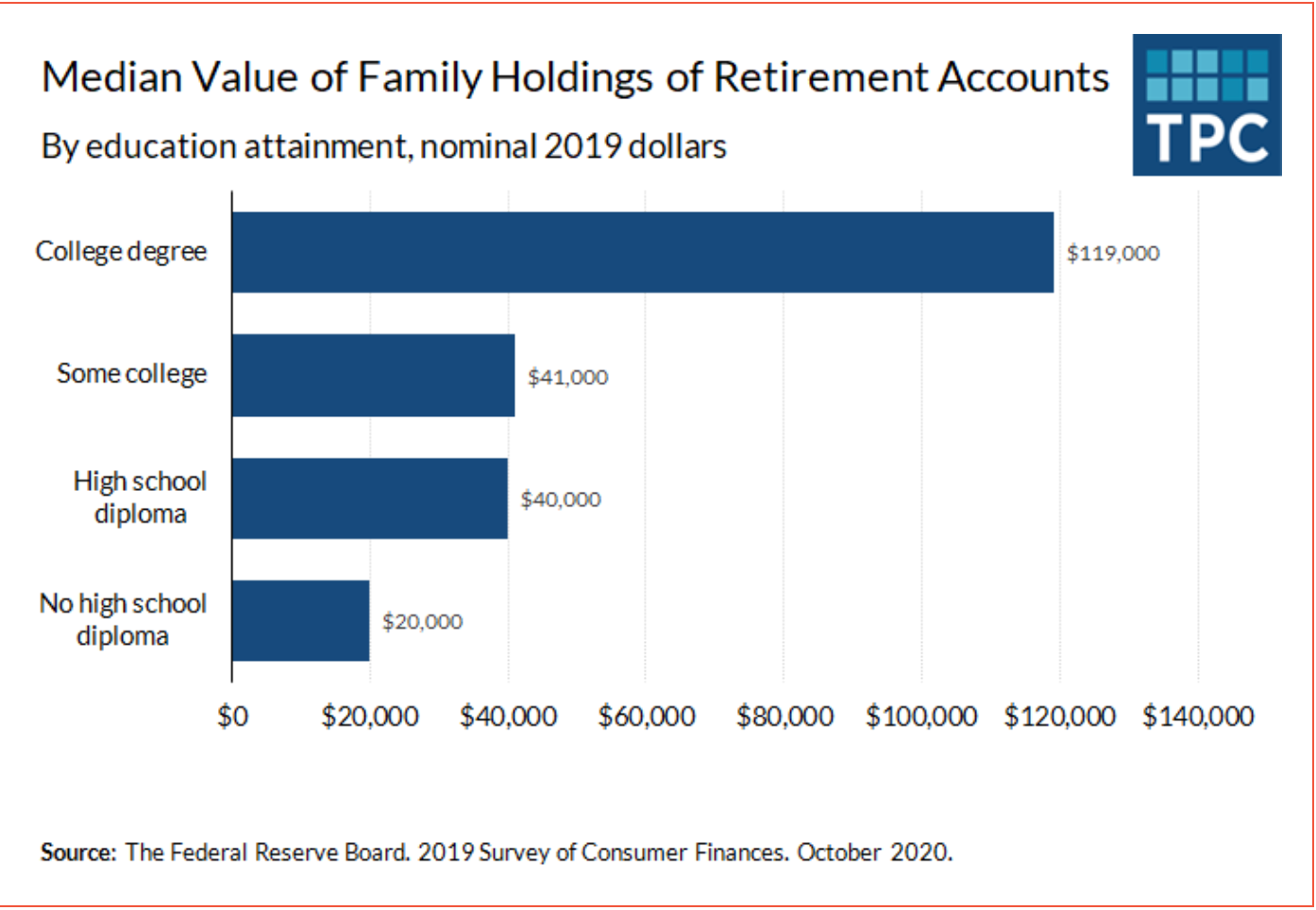

When it comes to retirement, most Americans are essentially relying on Social Security to fund their post-work lives. Even Americans with college degrees have very little saved for retirement, largely due to the lifestyle in which they live beyond their means annually so save very little for the future.

Is there a way back from this financial ledge? Probably not short of re-ingraining in Americans the concept of delayed gratification and living within your means, which is made even harder by social media that makes it seem like everyone can fly in private jets with their Birkin bags to exotic locations around the world. Beyond the debt servicing challenge, this bifurcated economic reality that creates few winners and lots of losers is another part of what is driving Americans apart and undermining our (somewhat) capitalist system. Without a pressure release valve that expands the circle of winners, economic and political unrest will grow and grow more violent. And, for my friends on the Left, more government spending for entitlement programs and the like only results in higher deficits and debt, which push interest rates and inflation higher thereby hurting the very people you are trying to help even more.

More government spending is simply not the answer. So, despite the sycophants who cheer Bidenomics, the last three years have erased the broad-based economic advances made under Donald Trump and made things worse for the vast majority of Americans in their daily lives. As James Carville famously said in 1992, “It’s the economy, stupid!”

So very well laid out, backed and explained. I wish everyone, especially high school and college students would read, understand and use it to make decisions for multiple aspects of life. In doing so, since I'm going all in, I hope they'd teach their children to do the same.