Don’t Believe the Hype: You Should Ignore Most Media Declarations About Donald Trump and the Economy

I am not a financial advisor nor do I play one on television. I am, however, a common sense investor in both my 401(k) and brokerage accounts. On April 2 when Donald Trump announced an avalanche of tariffs would fall upon every country, the Left and its sycophants in the mainstream media immediately predicted doom and gloom for America, its citizens, and our economy. Week-after-week they told us that everyone investing in the equities markets were losing their retirements and other investments. It was going to be 1929 all over again.

So, where do the equities markets stand one month later? The table below shows the prices before the markets opened on April 2 when Trump made his announcement compared to where the markets closed on Friday, May 2.

As you can see, the Dow Jones Industrial Average is down 2.15%, while the Standard & Poor 500 (S&P500) and NASDAQ are up 0.28% and 2.14%, respectively. Before I divulge the state of my portfolios, I need to state that I am an index fund guy combined with a buy-and-hold mostly dividend-paying blue chip companies guy. I enter the equity markets with a few rock hard assumptions: (1) beating the market via a timed buy and sell approach is not much different than playing the roulette wheel in Las Vegas; (2) over time, a few private and professional investors who churn equities can beat the S&P500, but most don’t; and (3) risk should always be aligned with how close you are to retirement with risk taking more tolerable the farther you are from retirement knowing you have time to recover and vice-versa. With those assumptions in mind, over the last month my 401(k) and brokerage accounts rose by 0.61% and 3.53%, respectively. Thus, I bested all three equity markets with an average increase of 2.69% by doing literally nothing over the last month except watch.

I don’t divulge this personal information to brag; rather, I reveal it to show just how wrong the Left and the media have been on the impacts of Trump’s tariffs over the last month. That isn’t to say that the markets won’t rise and fall over the coming weeks and months as the tariff war with China moves forward. Of course that will happen, as it always does over the course of time. The key question to ponder is this: will the trade deals cut with the vast majority of countries that want to cut a deal with America counterbalance the ongoing and very necessary trade war with China? I believe the answer is yes, which means the equities markets will rise and fall on other metrics like Gross Domestic Product, consumer spending, and job growth. The second question to consider is: can China really fight a long trade war with America knowing other countries are cutting deals to steal market share from China? I’d suggest the answer is not on your life, which is why China will huff and puff to save face, but will eventually concede a large chunk of ground to reach a more palatable trade deal with America.

Here are the latest impacts Trump’s tariff fight is having in China:

They are in the huge piles of containers that missed the April 9 tariff deadline, sitting in Chinese ports. These are filled with goods that the tariffs have priced out of the US market. Meanwhile, cargo bookings for container voyages between China and the US are down by half.

They are in deserted factory floors all along the coast of China, where workers are being laid off by the tens of thousands. Textile, toy, electronic, and furniture factories are just a few of the industries being crushed by the tariffs.

They are in the empty streets and shuttered shops of the surrounding industrial towns and cities, whose one-time customers—the now unemployed factory workers—can’t afford to eat or shop in their favorite noodle stand or convenience stores.

America is by far China’s largest customer, absorbing about one-sixth of China’s exports. If the tariffs stay in place for any length of time, economists estimate that 80% of China’s goods will be priced out of the American market, representing a loss of almost $400 billion.

As many as 10 million Chinese workers might lose their jobs over the next few weeks, says Treasury Secretary Scott Bessent, a number that could easily double in the months that follow as the ripple effects of the slowdown tear through the economy.

So, ignore the naysayers. America is winning. Bigly:-)

The Left and media also are using lots of polling data to show that Trump is losing popularity because of his policy decisions. Let me state it is clearly as possible. The polls today don’t matter one iota. Taking tough, but necessary, actions is hard work. The actions and/or their consequences can impact people in ways that cause harm in the short term. If the actions are the right ones, then the harm will be short term. Once the actions begin to produce results, the short term pain will turn into long term gain. History shows this outcome to be the case.

After defeating Jimmy Carter in the 1980 presidential election, Ronald Reagan and his team faced the daunting tasks of tackling stagflation, a moribund economy, and an advancing Soviet Union. Reagan, working with Federal Reserve Chairman Paul Volcker, opted to take difficult steps that they knew would cause more unemployment and financial pain in the short term, but would tame inflation and reset the American economy to roar like never before. In the first quarter of 1983, Reagan’s disapproval numbers reached a high of 59%, as Americans faced enormous financial difficulties. Many members of his administration begged Reagan to stop pushing the medicine he knew America had to take to get stronger. Many believed Reagan shouldn’t even run for reelection. Reagan stood strong against the wave of disapproval.

Then, as expected, the economy came roaring back leading to Reagan’s historic 1984 landslide reelection and the largest economic expansion in American history. That expansion allowed Reagan to rebuild America’s military then push the Soviet Union to collapse in 1991. The rest, as they say, is history. This historic tidbit is important when viewing the Trump tariff fight with countries that have taken advantage of America for fifty years mostly to the detriment of our middle and working class. Yes, it is possible Trump mishandles the tariff fight leaving America weaker rather than stronger, but that outcome is highly unlikely given the strong team he has in place aiding his decision making (not to mention access to the world’s best market). It is far more likely that Trump will cut deals with more than 100 countries that put America, its businesses, and its consumers in a far better position vis-a-vis trade than where we stand today. Those deals also will put enormous pressure on China to cut a deal with America that substantially rebalances the trade relationship between us.

I suspect Trump’s team is moving as quickly and as aggressively as possible to finalize the contours of a majority of trade deals by the end of the year so that any economic hiccup is short and de minimus. Concurrently, I expect Congress to pass a tax cut package in the near future that will stimulate the economy and the American consumer. When you add in Trump’s actions on illegal immigration and squeezing waste, fraud, and abuse out of the federal government, Trump’s final three years should be far more gain than pain. Thus, like Reagan in 1983 after the pain required in 1981-1982, Trump in early 2026 will see his disapproval numbers decline and his approval numbers rise. From a timing standpoint, the 2026 midterm elections will arrive as the now reset American economy will be getting stronger and stronger. That bodes well for gaining seats in both chambers in Congress. By the 2028 presidential election, J.D. Vance will have a very strong record upon which to seek the presidency in his own right (as will Marco Rubio—might we see a Vance-Rubio ticket?).

When media coverage runs 92% negative on Trump’s first 100 days versus 59% positive on Joe Biden’s first 100 days, you can freely ignore virtually everything they report and say. Americans gave Trump a mandate to make America stronger. Have faith that he is doing exactly that by showing less instant gratification bedwetting and more delayed gratification perseverance.

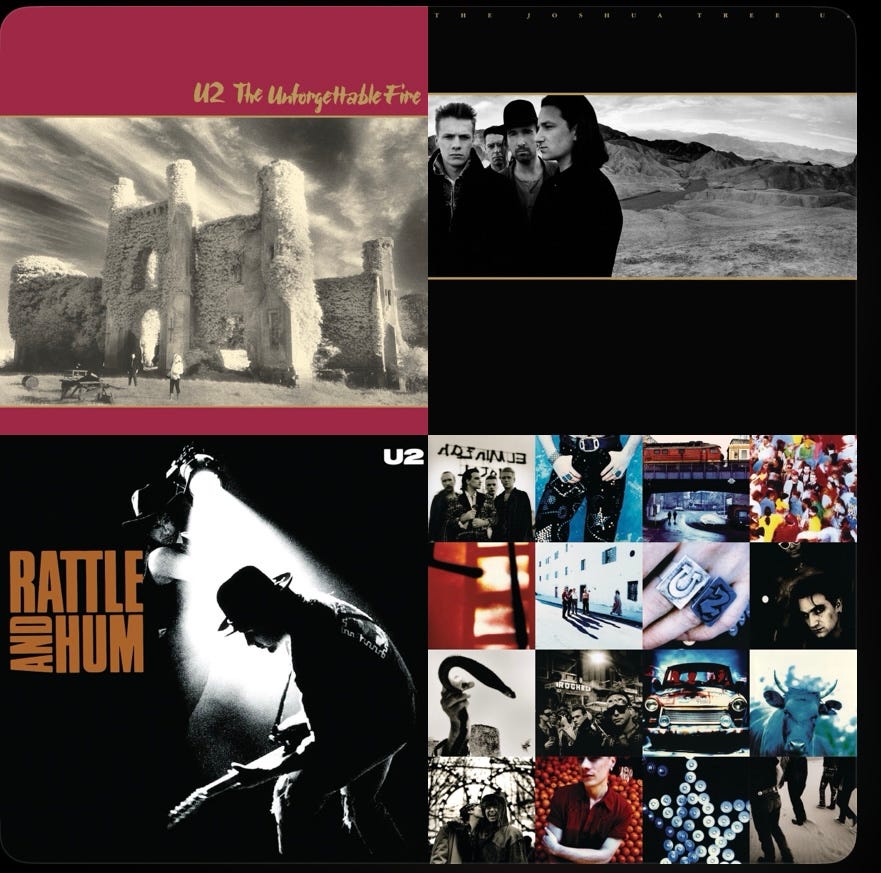

P.S. On a totally unrelated note, do you like music? I love it. All kinds of it. Based on my nearly five decades of listening to music, I believe U2’s four albums released over the seven years from 1984 to 1991 represent that greatest production of music in non-classical music history. Virtually every song on each album is worth listening to (i.e., there were no B side inclusions just to put out a whole album and no skipping songs). Starting with "The Unforgettable Fire" in 1984 followed by the mega hit "The Joshua Tree" in 1987 then a year later the documentary and album “Rattle and Hum” after which U2 launched its more experimental phase with 1991’s “Actung Baby,” the four successive records contained more hits and worth listening to songs than any other band or singer since 1960. Look at this partial list of songs:

The Unforgettable Fire

A Sort of Homecoming

Pride (In the Name of Love)

Bad (Live)

Elvis Presley and America

The Joshua Tree

Where the Streets Have No Name

I Still Haven’t Found What I’m Looking For

With or Without You

Running to Stand Still

In God’s Country

One Tree Hill

Mothers of the Disappeared

Rattle and Hum

Desire

Hawkmoon

Angel of Harlem

Love Rescue Me

Heartland

All I Want Is You

Actung Baby

Zoo Station

One

Who’s Gonna Ride Your Wild Horses

So Cruel

Mysterious Ways

Acrobat

Love Is Blindness

There is a reason U2 has sold roughly 170 million records worldwide. According to Pollstar, U2 was the second highest grossing group from 1980 to 2022 when it earned $2.127 billion from 26.2 million tickets. U2 has won more Grammy Awards than any other group. Now, I’m not a blind follower, as I think most of what U2 has produced since 1991 has been forgettable and wish they would seek to find the sweet spot achieved in 1987 before they end their musical journey. If you have Apple Music or Spotify, make a playlist with these four albums then go for a long walk or drive and you’ll understand why I stand behind my claim that these seven magical years represent the greatest compilation in music history.

If you think I’m wrong, list your winner in the comments and please spare me the cliche that The Beatles were better over the course of four albums. They simply weren’t. Yes, they produced lots of albums from 1960 to 1970, but most of those albums had one, maybe two, songs worth listening to again and again. If Morgan Wallen’s upcoming double album, “I’m the Problem,” lives up to the production of his two previous double albums, 2021’s “Dangerous” and 2023’s “One Thing at a Time,” then I’d nominate him, as all three albums over just four years contain ninety-eight mostly excellent country songs that place him among the greatest country singers ever.

Special thanks to my lovely lady friend who so perfectly reminded me of how much I love U2’s 1984 to 1991 work by whisking me off to Las Vegas to see the very cool U2 movie at the mind-blowing venue, The Sphere.

Matt:

I'm not going to debate you about U2....I agree those were very good albums and years. Here are a few other album streaks I really like (not claiming they are technically great or anything....just very good according to my music taste):

-REM's first 4 albums (Murmur to Life's Rich Pageant)

-The Cure 4 albums from Head on the Door through to Wish

Couple other more obscure ones for you:

-I love all 4 of Chvrches first 4 albums

-First 3 Kaiser Chiefs albums are about as enjoyable for me as it gets

(Have you checked out the band Inhaler? Bono's son is lead singer and in my opinion is going out of his way to earn his way without trading on his dad's name. Good band and his voice does sound a little like Bono)