A Brief Discussion on Eliminating Ohio Property Taxes

Plus, Tom Brady Needs to Stop Talking and Donald Trump Is Wrong About Nationalizing Intel--He Should Heed Ronald Reagan and Margaret Thatcher

Former State Representative John Adams recently called me to discuss the proposed initiative to eliminate Ohio’s property taxes. Our lively discussion led to me digging into a few items to put the debate in proper context. As I told John, if we were starting Ohio new today, we would not have used property taxes as the basis to fund local government; rather, we would have used sales taxes and, by doing so, would have been far more successful at constraining government growth. Why? People paying ever-rising sales taxes on things they buy daily would be far more aggravating than paying a property tax bill once per year. As a result, government requests to keep hiking the sales tax would have met strong opposition, thereby forcing them to keep spending in check. I also told John that I thought such an initiative would fail because local governments, especially police, fire, and schools, would run television and social media ads pushing a parade of horribles should property taxes be eliminated, as they did with the Senate Bill 5 repeal initiative on government collective barging reform.

Based on 2022 data, Ohio property taxes raised about $19.5 billion for local government, with 60% or so going to schools. Of those funds, 90% go towards teacher and administrator pay and benefits. With Senate Bill 5’s defeat, there really is no way to cut or restrain local government pay and benefits. Big Labor is on one side of the negotiating table opposed by school board members elected by Big Labor’s members and donations. It is a heads we win, tails you lose scenario. Based on inflation and the more recent jump in property taxes, I estimate that Ohio property taxes will hit $25 billion in 2025. So, eliminating property taxes would presumably require raising the sales tax in Ohio.

How much of a sales tax hike?

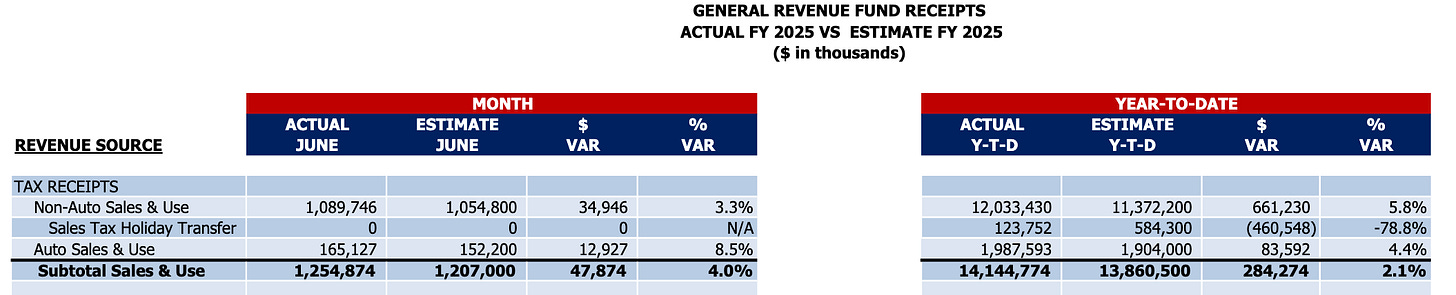

Well, in the state fiscal year that ended June 30, 2025, the 5.75% state sales tax raised $14.1 billion for state government, so local sales taxes would have to be raised at least that much. If my math is right, the $14.1 billion came from $245.2 billion in sales. That means to raise $25 billion to replace eliminated property taxes, local governments would have to have a tax rate of 10.0%, which along with the state sales tax of 5.75% would push Ohio’s combined sales tax to 15.75% on all purchases. Currently, Louisiana has the highest combined state and local sales tax at 10.12%, so an Ohio sales tax of 15.75% would far and away become the highest sales tax in America. That level of taxation would make Ohio even more unattractive than it already is. Thus, while eliminating property taxes sounds great to those of us paying high property tax bills, I don’t think I would trade it for substantially higher sales taxes on everything I consumed every day. Would you?

I think a far likelier approach would be to pass an initiative that substantially slows the growth of local government going forward by constraining property and sales tax increases. Without government collective bargaining reform, the only viable way to slow local government spending is to consolidate governments to eliminate lots of administrative jobs (i.e., quad-county governments or school districts), eliminate teaching jobs in school districts that have declining enrollment, and, most importantly for the long term, move all government workers from a defined benefit (DB) retirement pension to a defined contrition (DC) retirement account. To hold existing workers harmless, I’d propose current government workers be grandfathered so they can keep their DB pension, but that all new government workers be given a DC account. Based on Michigan doing this exact transition starting in 1997, Visiting Fellow Mary McCleary previously estimated it would take about twenty-nine years to transition from 100% DB pensions to 100% DC accounts for government workers.

If there is a funding gap due to a decreasing number of government workers paying into the DB system as the years go by, a temporary "pension transition tax" may be required to fill the gap. How this tax would work and to whom or what it would apply (i.e., existing government pension benefits) could be part of the negotiation, but it likely would be needed. Once the transition is done, that temporary tax would be eliminated and, thankfully, taxpayers would NEVER be on the hook again for underfunded/overpromised government defined benefit plans, as is the case today. Had Governor John Kasich and the Ohio General Assembly listened to Mary when she issued her excellent policy recommendation*, Ohio today would have a majority of government workers in the DC account (58%) with 42% still in DB pensions and savings to Ohioans of $1.5 billion.

*Please note: Mary wrote her piece when I ran The Buckeye Institute and she was our Senior Policy Analyst, but they’ve since removed all work done before their current president’s tenure from their website so I linked the piece (and all of our excellent work from 2009-2011) on the Opportunity Ohio website.

With Vivek Ramaswamy in support of property tax reform, there is hope that Ohio will do something positive to rein in increases. It is one thing to have high property taxes when you don’t pay an income tax. To get it with both is tough on most people.

P.S. No. When I saw the news report that Donald Trump proposed that the U.S. Government take ownership in Intel due to Intel’s dire fiscal condition and its role in semiconductors, my brain screamed, “NO!!!!” Didn’t we on the Right spend decades fighting the nationalization of commerce that had occurred starting with Franklin Roosevelt? Didn’t we champion Ronald Reagan’s and United Kingdom Prime Minister Margaret Thatcher’s privatization of government industries? Haven’t we on the Right always pushed to keep government in the box of doing only what government can do more efficiently than the private sector? Nothing good can come from putting taxpayer funds at risk by partially nationalizing Intel because its leaders did a crap job of leading it. Intel certainly won’t become MORE EFFICIENT or BETTER RUN because the federal government owns part of it. Please don’t get swept up supporting everything Trump does without realizing Trump and his team won’t be in charge forever. What Trump justifies today, the Left will use to justify their actions tomorrow, including nationalizing more companies and/or industries due to “national security” grounds. Intel should either rise or fall on its ability to compete. Intel and the Ohio facility in Licking County are failing because Intel’s product offering is inferior to its market competitors. Nationalizing it won’t improve their product offerings. It will just make it too big to fail. Trump should be making America more attractive to other semiconductor manufacturers from any democratic country, not getting behind Intel because it is an American company and its project in Ohio is dying a slow and painful death, which could hurt Trump and J.D. Vance’s standing among Ohioans. And I say that as an Ohioan and as a long-time Intel shareholder (I purchased Intel stock in June 2010—it has become one of my very few misses sadly).

P.P.S. Apparently, NFL all-time great Tom Brady wants to anger everyone with his commentary. Recently, he took a shot a Wayne Rooney for his apparent “lack of work ethic” when his was the coach of Birmingham Football Club of which Brady is a minority owner. Rooney responded politely that Brady just doesn’t understand football (i.e., American soccer). Rooney noted that NFL players only play one game a week for three months (six if you make it to the Super Bowl) while English football players play one-to-two matches per week from August to May (ten months), with some players then having additional playing duties for their countries and/or clubs. The NFL season is seventeen games plus the playoffs, with the Super Bowl Champion Eagles having played twenty-one games from September 6, 2024, to February 9, 2025. The English Premier League runs thirty-eight matches from mid-August to late May, with teams also playing FA Cup, Carabao Cup, and Champions or Europa League matches. My team, Manchester City (ManCity), played between sixty-two and seventy-one matches over the last five seasons, which equates to roughly 1.19 matches per week over fifty-two weeks.

As a former soccer player for twenty-one years and coach for another seventeen seasons, Brady’s ignorance goes far beyond just noting what wasn’t happening the day before a match. Specifically, according to Quartz and Pro Football Network, an average NFL game covers 11-18 minutes of active play out of the sixty minute game. Given that players are either offensive or defensive players, at most, an NFL player is actively playing for about 6-9 minutes a game. Did you know so little actually happens at NFL games? So, for an Eagles starter who played every offensive down of last season, he would have played for approximately 189 minutes the entire season and ran at most 26.25 miles (or a marathon). If you watch NFL football games, there is A LOT, and I mean A LOT, of standing around time in between actual live play.

In stark contrast, soccer matches are ninety minutes long with two forty-five minute halves in which players are constantly in motion for the entire time they are on the field. Runner’s World estimates that an average soccer player runs roughly seven miles per match, while NFL receivers and cornerbacks may cover 1.25 miles (lineman and quarterbacks like Brady likely cover 0.25 miles). A ManCity starter who played every minute of every match would have racked up 5,580 minutes (nearly thirty times his NFL peer) and run 434 miles (or 16.5 times more than his NFL receiver peer). Of course, an NFL game is far more physical to the entire body than a soccer match, but the physical shape and recovery required to play soccer for so long and so often far outstrips what is required for NFL games.

Brady may have been the GOAT in football, but he is a DUNCE when it comes to real football.

I follow Matt Mayer and like his work, but this one misses the mark for me.

Focusing only on the property tax/school & local government funding piece of this article, this post, for me, falls short of where I'd hoped he'd go.

Last-Place/Most-Expensive schools, sitting on roughly $10 billion of surplus funds is a great opportunity to force a massive re-evaluation. A reported *majority* of graduates being ineffective at reading, writing, math, or basic understanding of geography and government, while some districts are spending $15, $20, $30, and even over $40,000 per student... this isn't a circumstance under which I'm willing to accept the notion of replacing one tax with another in order to maintain status quo. Status quo is fundamentally, horribly, egregiously broken.

That, for me, is the starting point. Return to "you have one job, the pursuit of Academic Excellence" and eliminate any/every expense not directly related to it. This means the endless parade of construction projects, most of the "administrators", and a lot more unnecessary spending.